In case you missed it, where Murdock’s 21st Century Fox failed, AT&T is making their play to acquire Time Warner, Inc., Comcast customers paying more for streaming gets the internet and cable provider in hot water, and UK consumers say most streaming music subscriptions are too high.

And there’s more, so read on…

There was a teaser bit of news on Friday that AT&T may be making a bid for Time Warner, Inc., and by Saturday AT&T made it final that the two conglomerates had committed to getting into bed together. This potential marriage will have a long engagement period, with many hurdles for the two companies to get over in 2017, including a lot of due diligence by the Federal Communication Commission and the U.S. Department of Justice, along with gluttony of scrutiny from consumer watch groups.

The myriad of news stories batted about how the telecommunications, internet, and wireless company would benefit greatly from a competitive stance, especially against Comcast and the acquisition of NBC Universal, which many believe did not receive enough due diligence by the FCC and DOJ.

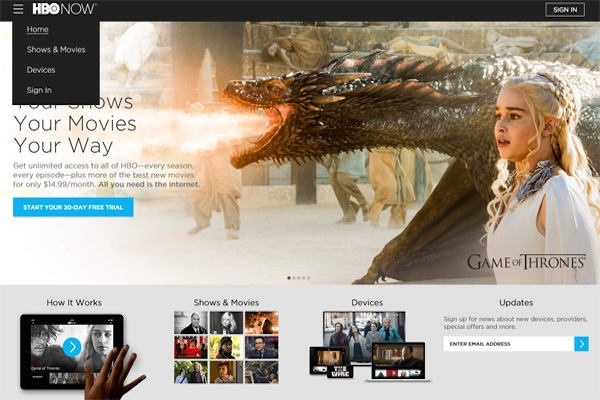

“By acquiring Time-Warner, owner of CNN, HBO and Warner Bros. studios, it will have access to a vast library of content that includes the Harry Potter franchise and ‘Game of Thrones,'” wrote Jim Zarroli and Bill Chappell of NPR.

Referring back to Comcast and General Electric, they announced their joint venture in the NBCUniversal business in 2009, but the transaction wasn’t completed until 2011 (and Comcast eventually bought out GE in 2013). So a year’s time, as some predict, to get this massive venture approved and finalized may be optimistic.

More to come on this one.

Speaking of Comcast…

Photo: Alyson Hurt

Looked at Your Comcast Bill Lately? Why Streaming May Be Costing You More Than It Should

“Ever had an outrageous cable bill?” asked DailyTech writer, Elloy Bethell. I think any Comcast customer can answer, “YES!” to that one, and it may be because those higher charges weren’t justified. It looks like I’m not the only one that has had been charged for a device I never had, or had a $99 internet installation fee that was supposed to be waived magically appear on my bill anyway.

Well, Comcast got caught. Or should I say, got their hand tapped, not slapped, with a measly $2.3 million dollar fine by the FCC for illegal billing practices.

Apparently it’s the “largest civil penalty ever placed on a cable company in the history of the Federal Communications Commission.” Just maybe, that’s a big part of the problem. Like Wells Fargo, these companies knowingly perform illegal deeds and just factor in the fine into their balance sheet, expecting that such actions will never result in paying the legal consequences (beyond small, coin-in-cushion fines) that are applied to the rest of us.

This investigation was undoubtedly sparked by Congress in February of this year. Yes, Congress. Six Democratic Senators – Ron Wyden, Bernie Sanders, Jeff Merkley, Al Franken, Ed Markey, and the almighty Elizabeth Warren – sent a letter to the FCC outlining customer complaints for unjustified charges. The six stated an estimated $275M and $300M a quarter is made by Comcast just on equipment fees; $10 a month for a $75 modem/router. Ars Technica posted Comcast’s response, which stated the company is “investing hundreds of millions of dollars” to improve their billing system and customer service. SFW. They want a pat on the back for doing the right thing, taking a whole three months of revenue to cover those costs of what they should already be doing right to begin with.

Going forward, “Comcast also has to take proactive measures to make sure this sort of issue does not happen again.” Oh, whatever.

The UK’s Music Streaming Market is Ripe for Growth, But at What Price?

CMU recently reported on research from YouGov and subscription technology company Zuora, which had surveyed 2000 UK consumers on their use of streaming services. Of those, 52% said as a result of their subscription, CD buying was off the table, and 37% only listened to radio on rare occasions (not sure if a differentiation was made between terrestrial or streaming radio).

With only a 10% market penetration, there’s 90% growth potential up for grabs, but based on the survey, the average £10 a month, or £120 a year may be too high for many.

For us music freaks that have habitually bought music on a regular basis and love the treasure trove of 40 million tracks to choose from, that £10 is a bargain, and most likely, that’s the main demographic of those that have signed up thus far. “But for consumers who [a] use to buy about two CDs a year and [b] never asked for access to 40 million tracks, the current offer is less attractive,” wrote CMU’s Chris Cooke.

After last week’s mid-tier pricing by Amazon, the market is keeping an eye on how they fare, along with Pandora and iHeart “who all have $4/5 options on the market or in the pipeline.”

Head of Zuora, Tien Tzuo, stated in the report, “The winner in this race will succeed by delivering the most compelling experiences matched with tailored pricing models that meet consumer expectations.”

Click here to get a copy of the report, “A Nation Subscribed: 2016 State of the UK Subscription Economy.”

Pandora Introduces AMP, Sophisticated Digital Marketing Tools for Artists

“Pandora started with a vision, inspired by my own experiences as a working musician,” said Tim Westergren, founder and CEO of Pandora, “To try to harness technology to make it easier for artists to make a living.” The company has now introduced a new marketing platform, Pandora AMP, designed to help break new artists, promote new music, and connect directly with fans to increase revenue opportunities.

According to Pandora, their 80 million monthly users make it the largest radio station in 49 markets across the U.S. The direct-to-fan component lies within AMPcast, an audio message tool to alert fans of new tracks, tour dates, or just share a personal message. Audio Messaging is another short-form audio format, which plays when a user clicks to an artists’ station or before/after a song is played. It can also be used as a follow up message when fans follow an artist’s social profiles.

Featured Tracks campaign highlights spins for an eight-week period, enabling listeners to rate it, and artists to boost awareness of their new music. It can also be tied to other campaigns, like Audio Messaging, which provides the artists with data on how and where their music resonated with fans. On the data and reporting side, the Next Big Sound analytics platform is part of this announcement and tool kit, collecting data across Pandora and providing reports to artists on their related campaigns, social media and video (expect that may include YouTube and Vimeo). Identifying cities where a band has a solid listening base helps in planning tours, and the acquisition of Ticketfly can also come into play, tying show routes to timed campaigns to promote ticket sales. Other analytics reveal how events, such as a TV appearance or in-store performance, impacted social engagement and listens on Pandora.

To check out the variety of education videos, one-sheets, and user guides for each piece of AMP, click the AMP Playbook.

In Other News…

Turner’s FilmStruck Moves Deadline for Launch – Last week Turner Broadcasting was set to enter the streaming fray by offering their brand of classic movies in a subscription video model under the FilmStruck moniker. A Tweet to followers announced that the launch date has been moved to November. Turner is also set to be pulled from Hulu on November 11, yet another content producer going away from the streaming subscription aggregator to venture out on their own.

AT&T Flips the Switch on Live TV Streaming on DirecTV Now – After AT&T’s 2015 acquisition of DirecTV last year, it’s been rolling out new features that emulate linear TV experiences for cord-cutting consumers. Free from the need of a dish or cable, or an annual contract, DirecTV Now is a video streaming service due out at the end of this year, which for a flat $50 a month, enables users to “stream dozens of live channels to televisions and mobile devices,” according to the WSJ. If the number of channels rivals Sling’s premium $75/month 100-channel service, it comes in at $25 lower. It may be cannibalizing its own cable subscription revenue, but it’s getting ahead of the game that’s inevitably going in this cable-less, video streaming direction, BUT keeping its customer base, even if it is at a lower rate. DirecTV Now could also nab consumers dropping cable subscriptions like Comcast Xfinity, who has yet to launch a similar service.

Bing and TuneIn Partner In Deep Link Online Radio – A new partnership between TuneIn and Bing will allow users to search for over 10,000 online radio stations within the browser, which will serve up a carousel with the most popular stations. Without leaving Bing or logging into TuneIn, they can “Listen Live,” clicking from one to another. This feature works on desktop and mobile, and Bing plans to add more stations from TuneIn’s 100,000 plus four million podcasts.